Note

This page was generated from docs/tutorials/03_european_call_option_pricing.ipynb.

Pricing European Call Options#

Introduction#

Suppose a European call option with strike price \(K\) and an underlying asset whose spot price at maturity \(S_T\) follows a given random distribution. The corresponding payoff function is defined as:

In the following, a quantum algorithm based on amplitude estimation is used to estimate the expected payoff, i.e., the fair price before discounting, for the option:

as well as the corresponding \(\Delta\), i.e., the derivative of the option price with respect to the spot price, defined as:

The approximation of the objective function and a general introduction to option pricing and risk analysis on quantum computers are given in the following papers:

[1]:

import matplotlib.pyplot as plt

%matplotlib inline

import numpy as np

from qiskit import QuantumCircuit

from qiskit_algorithms import IterativeAmplitudeEstimation, EstimationProblem

from qiskit.circuit.library import LinearAmplitudeFunction

from qiskit_aer.primitives import Sampler

from qiskit_finance.circuit.library import LogNormalDistribution

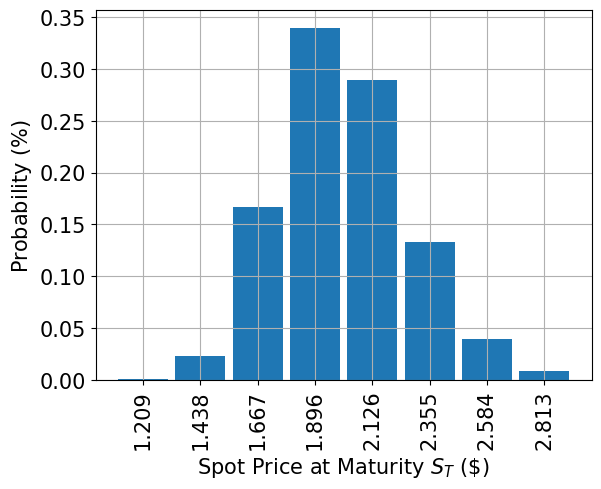

Uncertainty Model#

We construct a circuit to load a log-normal random distribution into a quantum state. The distribution is truncated to a given interval \([\text{low}, \text{high}]\) and discretized using \(2^n\) grid points, where \(n\) denotes the number of qubits used. The unitary operator corresponding to the circuit implements the following:

where \(p_i\) denote the probabilities corresponding to the truncated and discretized distribution and where \(i\) is mapped to the right interval using the affine map:

[2]:

# number of qubits to represent the uncertainty

num_uncertainty_qubits = 3

# parameters for considered random distribution

S = 2.0 # initial spot price

vol = 0.4 # volatility of 40%

r = 0.05 # annual interest rate of 4%

T = 40 / 365 # 40 days to maturity

# resulting parameters for log-normal distribution

mu = (r - 0.5 * vol**2) * T + np.log(S)

sigma = vol * np.sqrt(T)

mean = np.exp(mu + sigma**2 / 2)

variance = (np.exp(sigma**2) - 1) * np.exp(2 * mu + sigma**2)

stddev = np.sqrt(variance)

# lowest and highest value considered for the spot price; in between, an equidistant discretization is considered.

low = np.maximum(0, mean - 3 * stddev)

high = mean + 3 * stddev

# construct A operator for QAE for the payoff function by

# composing the uncertainty model and the objective

uncertainty_model = LogNormalDistribution(

num_uncertainty_qubits, mu=mu, sigma=sigma**2, bounds=(low, high)

)

[3]:

# plot probability distribution

x = uncertainty_model.values

y = uncertainty_model.probabilities

plt.bar(x, y, width=0.2)

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.grid()

plt.xlabel("Spot Price at Maturity $S_T$ (\$)", size=15)

plt.ylabel("Probability ($\%$)", size=15)

plt.show()

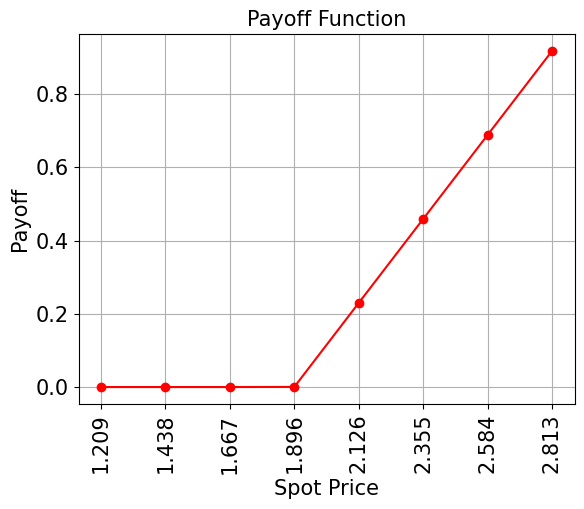

Payoff Function#

The payoff function equals zero as long as the spot price at maturity \(S_T\) is less than the strike price \(K\) and then increases linearly. The implementation uses a comparator, that flips an ancilla qubit from \(\big|0\rangle\) to \(\big|1\rangle\) if \(S_T \geq K\), and this ancilla is used to control the linear part of the payoff function.

The linear part itself is then approximated as follows. We exploit the fact that \(\sin^2(y + \pi/4) \approx y + 1/2\) for small \(|y|\). Thus, for a given approximation rescaling factor \(c_\text{approx} \in [0, 1]\) and \(x \in [0, 1]\) we consider

for small \(c_\text{approx}\).

We can easily construct an operator that acts as

using controlled Y-rotations.

Eventually, we are interested in the probability of measuring \(\big|1\rangle\) in the last qubit, which corresponds to \(\sin^2(a*x+b)\). Together with the approximation above, this allows to approximate the values of interest. The smaller we choose \(c_\text{approx}\), the better the approximation. However, since we are then estimating a property scaled by \(c_\text{approx}\), the number of evaluation qubits \(m\) needs to be adjusted accordingly.

For more details on the approximation, we refer to: Quantum Risk Analysis. Woerner, Egger. 2018.

[4]:

# set the strike price (should be within the low and the high value of the uncertainty)

strike_price = 1.896

# set the approximation scaling for the payoff function

c_approx = 0.25

# setup piecewise linear objective fcuntion

breakpoints = [low, strike_price]

slopes = [0, 1]

offsets = [0, 0]

f_min = 0

f_max = high - strike_price

european_call_objective = LinearAmplitudeFunction(

num_uncertainty_qubits,

slopes,

offsets,

domain=(low, high),

image=(f_min, f_max),

breakpoints=breakpoints,

rescaling_factor=c_approx,

)

# construct A operator for QAE for the payoff function by

# composing the uncertainty model and the objective

num_qubits = european_call_objective.num_qubits

european_call = QuantumCircuit(num_qubits)

european_call.append(uncertainty_model, range(num_uncertainty_qubits))

european_call.append(european_call_objective, range(num_qubits))

# draw the circuit

european_call.draw()

[4]:

┌───────┐┌────┐

q_0: ┤0 ├┤0 ├

│ ││ │

q_1: ┤1 P(X) ├┤1 ├

│ ││ │

q_2: ┤2 ├┤2 ├

└───────┘│ │

q_3: ─────────┤3 F ├

│ │

q_4: ─────────┤4 ├

│ │

q_5: ─────────┤5 ├

│ │

q_6: ─────────┤6 ├

└────┘[5]:

# plot exact payoff function (evaluated on the grid of the uncertainty model)

x = uncertainty_model.values

y = np.maximum(0, x - strike_price)

plt.plot(x, y, "ro-")

plt.grid()

plt.title("Payoff Function", size=15)

plt.xlabel("Spot Price", size=15)

plt.ylabel("Payoff", size=15)

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.show()

[6]:

# evaluate exact expected value (normalized to the [0, 1] interval)

exact_value = np.dot(uncertainty_model.probabilities, y)

exact_delta = sum(uncertainty_model.probabilities[x >= strike_price])

print("exact expected value:\t%.4f" % exact_value)

print("exact delta value: \t%.4f" % exact_delta)

exact expected value: 0.1623

exact delta value: 0.8098

Evaluate Expected Payoff#

[7]:

european_call.draw()

[7]:

┌───────┐┌────┐

q_0: ┤0 ├┤0 ├

│ ││ │

q_1: ┤1 P(X) ├┤1 ├

│ ││ │

q_2: ┤2 ├┤2 ├

└───────┘│ │

q_3: ─────────┤3 F ├

│ │

q_4: ─────────┤4 ├

│ │

q_5: ─────────┤5 ├

│ │

q_6: ─────────┤6 ├

└────┘[8]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = EstimationProblem(

state_preparation=european_call,

objective_qubits=[3],

post_processing=european_call_objective.post_processing,

)

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(

epsilon_target=epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

[9]:

result = ae.estimate(problem)

[10]:

conf_int = np.array(result.confidence_interval_processed)

print("Exact value: \t%.4f" % exact_value)

print("Estimated value: \t%.4f" % (result.estimation_processed))

print("Confidence interval:\t[%.4f, %.4f]" % tuple(conf_int))

Exact value: 0.1623

Estimated value: 0.1687

Confidence interval: [0.1637, 0.1737]

Instead of constructing these circuits manually, the Qiskit Finance module offers the EuropeanCallPricing circuit, which already implements this functionality as a building block.

[11]:

from qiskit_finance.applications.estimation import EuropeanCallPricing

european_call_pricing = EuropeanCallPricing(

num_state_qubits=num_uncertainty_qubits,

strike_price=strike_price,

rescaling_factor=c_approx,

bounds=(low, high),

uncertainty_model=uncertainty_model,

)

[12]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = european_call_pricing.to_estimation_problem()

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(

epsilon_target=epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

result = ae.estimate(problem)

conf_int = np.array(result.confidence_interval_processed)

print("Exact value: \t%.4f" % exact_value)

print("Estimated value: \t%.4f" % (european_call_pricing.interpret(result)))

print("Confidence interval:\t[%.4f, %.4f]" % tuple(conf_int))

Exact value: 0.1623

Estimated value: 0.1687

Confidence interval: [0.1637, 0.1737]

Evaluate Delta#

The Delta is a bit simpler to evaluate than the expected payoff. Similarly to the expected payoff, we use a comparator circuit and an ancilla qubit to identify the cases where \(S_T > K\). However, since we are only interested in the probability of this condition being true, we can directly use this ancilla qubit as the objective qubit in amplitude estimation without any further approximation.

[13]:

from qiskit_finance.applications.estimation import EuropeanCallDelta

european_call_delta = EuropeanCallDelta(

num_state_qubits=num_uncertainty_qubits,

strike_price=strike_price,

bounds=(low, high),

uncertainty_model=uncertainty_model,

)

[14]:

european_call_delta._objective.decompose().draw()

[14]:

┌──────┐

state_0: ┤0 ├

│ │

state_1: ┤1 ├

│ │

state_2: ┤2 ├

│ cmp │

state_3: ┤3 ├

│ │

work_0: ┤4 ├

│ │

work_1: ┤5 ├

└──────┘[15]:

european_call_delta_circ = QuantumCircuit(european_call_delta._objective.num_qubits)

european_call_delta_circ.append(uncertainty_model, range(num_uncertainty_qubits))

european_call_delta_circ.append(

european_call_delta._objective, range(european_call_delta._objective.num_qubits)

)

european_call_delta_circ.draw()

[15]:

┌───────┐┌──────┐

q_0: ┤0 ├┤0 ├

│ ││ │

q_1: ┤1 P(X) ├┤1 ├

│ ││ │

q_2: ┤2 ├┤2 ├

└───────┘│ ECD │

q_3: ─────────┤3 ├

│ │

q_4: ─────────┤4 ├

│ │

q_5: ─────────┤5 ├

└──────┘[16]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

problem = european_call_delta.to_estimation_problem()

# construct amplitude estimation

ae_delta = IterativeAmplitudeEstimation(

epsilon_target=epsilon, alpha=alpha, sampler=Sampler(run_options={"shots": 100, "seed": 75})

)

[17]:

result_delta = ae_delta.estimate(problem)

[18]:

conf_int = np.array(result_delta.confidence_interval_processed)

print("Exact delta: \t%.4f" % exact_delta)

print("Estimated value: \t%.4f" % european_call_delta.interpret(result_delta))

print("Confidence interval: \t[%.4f, %.4f]" % tuple(conf_int))

Exact delta: 0.8098

Estimated value: 0.8091

Confidence interval: [0.8034, 0.8148]

[19]:

import tutorial_magics

%qiskit_version_table

%qiskit_copyright

Version Information

| Software | Version |

|---|---|

qiskit | 1.0.1 |

qiskit_finance | 0.4.1 |

qiskit_algorithms | 0.3.0 |

qiskit_aer | 0.13.3 |

qiskit_optimization | 0.6.1 |

| System information | |

| Python version | 3.8.18 |

| OS | Linux |

| Thu Feb 29 03:06:14 2024 UTC | |

This code is a part of a Qiskit project

© Copyright IBM 2017, 2024.

This code is licensed under the Apache License, Version 2.0. You may

obtain a copy of this license in the LICENSE.txt file in the root directory

of this source tree or at http://www.apache.org/licenses/LICENSE-2.0.

Any modifications or derivative works of this code must retain this

copyright notice, and modified files need to carry a notice indicating

that they have been altered from the originals.

[ ]: